Earlier this month, Vanguard released their Assessing the Value of Advice paper and it had a lot of great information. The report analyzed the impact of financial advice among more than 100,000 participants. Their framework (Figure 1) defines 3 dimensions of potential value for advice:

- Portfolio

- Financial

- Emotional

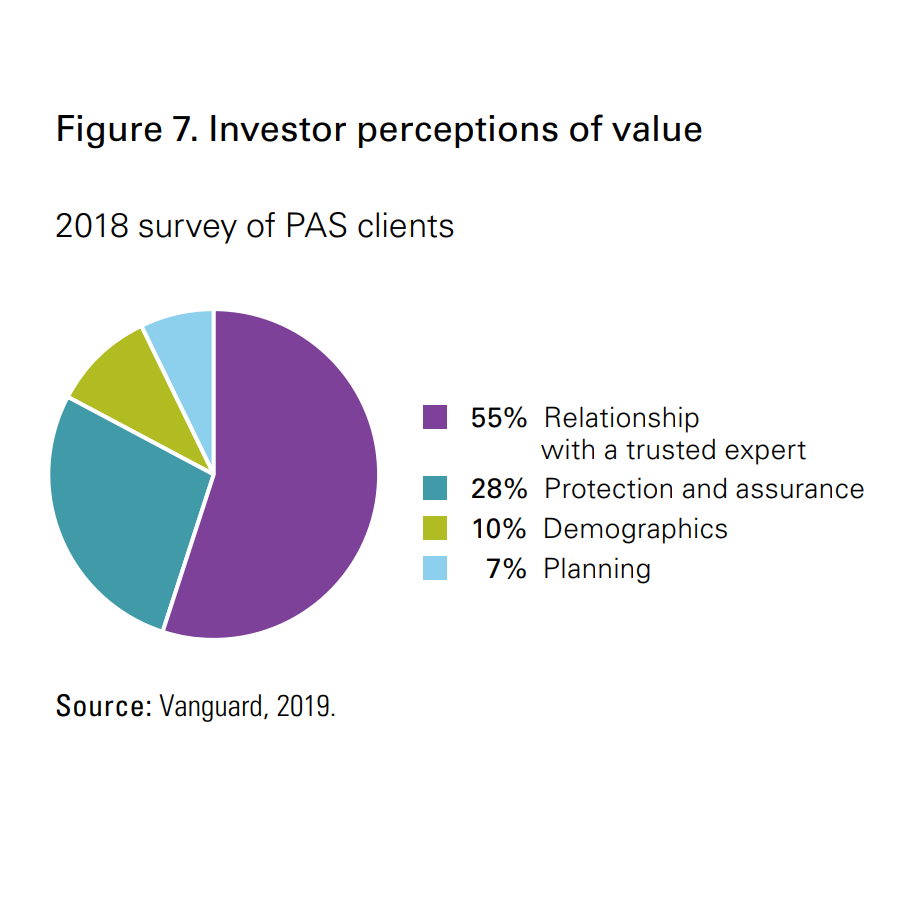

So what elements led to the highest perceived value by investors? Over half of it came from relationship with a trusted expert. Another 28% came from protection and assurance. About 10% was attributable to differences in household demographics. Surprisingly only 7% came from planning. (Figures 7 & 8)

In summary, Vanguard said “Our results highlight the need for a broader advisory industry investment in value metrics. Assessing value for money for the investor must begin with a comprehensive measure of value. As the industry grows in scale and impact and the emphasis on investor value continues, additional data-driven benchmarks will be needed to evaluate advisor quality and efficacy. These metrics will have to extend beyond traditional portfolio outcomes to encompass broader financial goal attainment and emotional well-being.”